Location, location, location…the

real estate 101 catch phrase we’re all familiar with, if not engrossed in.

Why

is location so important, though?

Practically every aspect of a

home can be altered or changed with enough money, time and resources, except

location. Even the most serious of home defects, such as foundations,

structures, roofs or new electrical systems can be fortified, updated, replaced

or repaired.

Then

what determines a locations desirability?

If you’ve ever owned a home, you

might understand how your neighbor’s home, the foreclosure down the street,

city school systems, tax funding, and new development impact your home’s value.

As many additional aspects also contribute to desirable locations and home

values, these main components lead most people to avoid all properties in certain

locations. Some people know so much about a location that they don’t even

realize they missed a diamond in the rough because they failed to explore or

reach outside of their single strategy.

Ready for one of the best kept

secrets in the real estate market that the wisest investors don’t want you to

know? You can make money in any location,

through smart investments, by applying the correct strategy to the current

market cycle.

What

do you mean? What is a market cycle strategy?

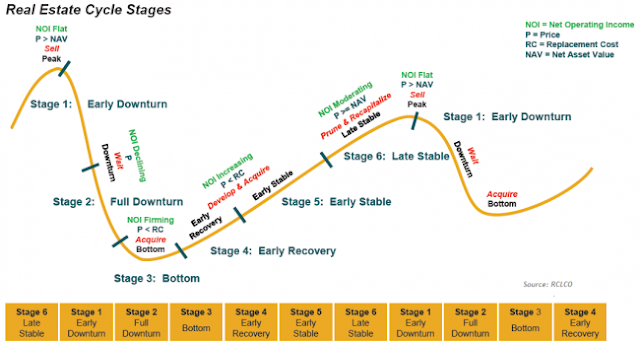

Almost every aspect of investing

(e.g. stocks, bonds, real estate, etc.) have market cycles. Within the real

estate market specifically, there are common cycle points, often referred to

through different names, including: Peak, Early Downturn, Full Downturn,

Bottom, Early Recovery, Early Stable, and Late Stable. Check out the graph from

Creonline.com below for a visual.

When viewing a historical market

cycle via line graphs, you’ll generally notice that the market resembles a

roller-coaster. That’s because the cycle is progressively advancing through each stage of the market over time. This is caused by various means, but can often

result in those who own real estate applying the incorrect strategy, not

understanding that it is commonplace for a market to bottom out and peak, for

instance.

Often times missing the correct

point to apply a certain strategy will lead to selling at the time you should

be holding, renting to a tenant when you should be selling, and overpaying

purchase costs due to a lack of inventory or decision to follow the crowd.

So

which strategy should I apply during each cycle?

The answer to this question is

complex, but on a basic level real estate owners who generate wealth typically

apply these general strategies during each respective point in the market

cycle:

1) Peak: Sell

2) Early Downturn: Sell or Hold

3) Full Downturn: Hold or Acquire

4) Bottom: Acquire

5) Early Recovery: Acquire,

Develop and Explore Renting

6) Late Stable: Rent, Refinance,

Improve, and Prepare for Selling

7) Peak: Sell

Next week we’ll check out more in depth information on each specific cycle and explore various strategies that can be applied to any location, as long as it’s the right time.

Until next time, make sure to Know the Home Before You Buy™ by obtaining your Home Fax™ Report and other real estate information from www.NationwideHomeFax.com and of course, all of your inspection needs from Home Fax™ Inspections!

No comments:

Post a Comment